Governance, Risk, and Compliance (GRC)

What is GRC?

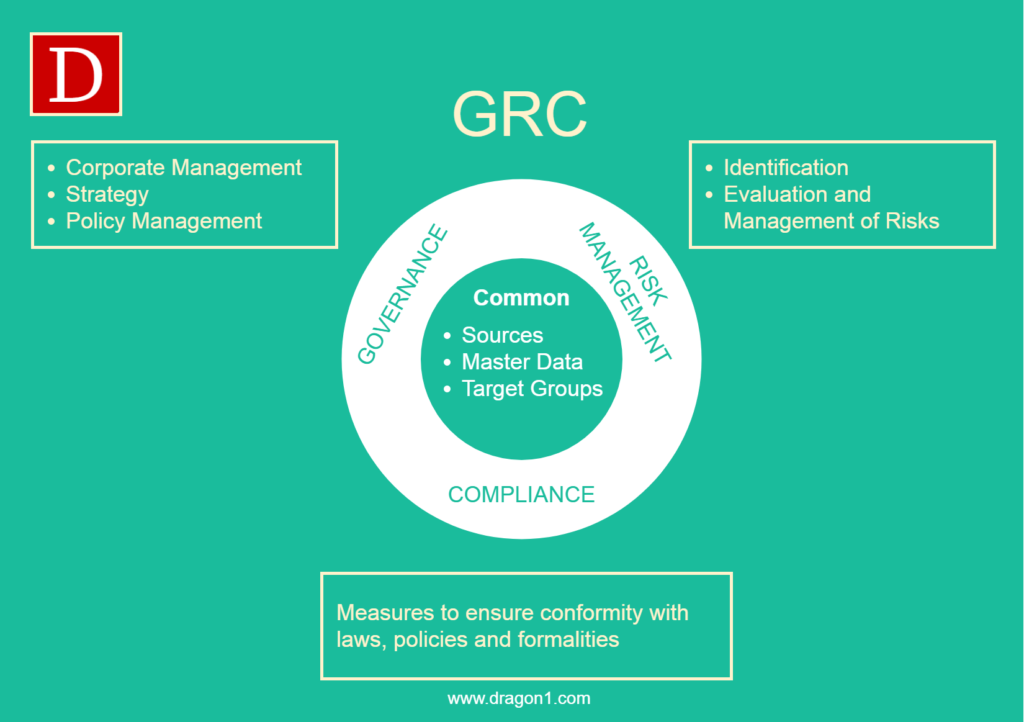

Governance, Risk, and Compliance (GRC) is a structured way to align IT with business goals while managing risks and meeting all industry and government regulations. It includes tools and processes to unify an organization’s governance and risk management with its technological innovation and adoption. Companies use GRC to achieve organizational goals reliably, remove uncertainty, and meet compliance requirements.

What does GRC stand for?

Governance

Governance is the set of policies, rules, or frameworks that a company uses to achieve its business goals. It defines the responsibilities of key stakeholders, such as the board of directors and senior management. For example, good corporate governance supports your team in including the company’s social responsibility policy in their plans.

Good governance includes the following:

Risk management

Businesses face different types of risks, including financial, legal, strategic, and security risks. Proper risk management helps businesses identify these risks and find ways to remediate any that are found. Companies use an enterprise risk management program to predict potential problems and minimize losses. For example, you can use risk assessment to find security loopholes in your computer system and apply a fix.

Ethics and accountability

Transparent information sharing

Conflict resolution policies

Resource management

Governance, Risk, and Compliance (GRC): A Comprehensive Guide

Abstract

Governance, Risk, and Compliance (GRC) is an integrated approach to managing an organization’s overall governance, enterprise risk management, and regulatory compliance. In today’s fast-evolving business landscape, GRC plays a critical role in enhancing organizational performance, ensuring adherence to laws and regulations, and mitigating risks. This article explores the core principles of GRC, its significance, frameworks, challenges, and its future in the digital age.

1. Introduction to GRC

Historically, governance, risk management, and compliance were treated as separate disciplines, managed in silos across different departments. However, as the complexity of global business environments increased, organizations began to recognize the value of a unified approach to managing governance, risk, and compliance processes. This integrated approach enhances decision-making, reduces the potential for operational failures, and fosters an ethical and compliant organizational culture.

1.1 The Importance of GRC

The adoption of GRC is crucial for the following reasons:

- Regulatory pressure: Global organizations must comply with multiple regulatory frameworks, such as GDPR, HIPAA, and SOX, and failure to comply can result in fines and reputational damage.

- Operational complexity: Businesses face multifaceted risks, from cyber threats to supply chain disruptions, which necessitate effective risk management strategies.

- Reputation management: GRC helps protect an organization’s reputation by promoting transparency, accountability, and responsible business practices.

- Financial stability: Proper governance and risk management ensure that an organization can anticipate potential issues, avoid costly mistakes, and maintain a strong financial standing.

2. Governance in GRC

Governance refers to the frameworks, processes, and practices that ensure the effective management of an organization. It encompasses the decision-making processes by which an organization is directed and controlled. In the context of GRC, governance ensures that an organization’s activities are aligned with its mission, values, and business objectives.

2.1 Elements of Corporate Governance

Effective corporate governance includes the following key components:

- Board of Directors: The board is responsible for setting the strategic direction of the organization and ensuring that management executes the business plan efficiently.

- Accountability: Transparent reporting and accountability ensure that stakeholders are kept informed about the organization’s performance and management practices.

- Ethical Leadership: Ethical leadership promotes a culture of integrity and honesty, ensuring that decisions are made in the best interest of the organization and its stakeholders.

- Internal Controls: Internal controls are processes put in place to ensure the accuracy and reliability of financial reporting and compliance with laws and regulations.

2.2 Governance Frameworks

Several governance frameworks help guide the implementation of effective governance structures:

- COSO Framework: The Committee of Sponsoring Organizations of the Treadway Commission (COSO) framework provides guidelines on governance, risk management, and internal controls. It emphasizes the need for organizations to integrate these components to achieve their objectives.

- OECD Principles of Corporate Governance: Developed by the Organization for Economic Cooperation and Development (OECD), these principles provide guidelines for governments and businesses to enhance transparency, accountability, and ethical leadership.

2.3 The Role of Governance in GRC

In a GRC context, governance provides the foundation for risk management and compliance by setting the tone for how risks are identified and managed and how compliance with internal policies and external regulations is achieved. Governance ensures that:

- Decisions align with strategic objectives.

- Risk management and compliance are integrated into the overall organizational framework.

- Accountability and transparency are maintained across all levels of the organization.

3. Risk Management in GRC

Risk management is the process of identifying, assessing, mitigating, and monitoring risks that may impact an organization’s ability to achieve its objectives. Risks can arise from internal factors, such as operational inefficiencies or human error, and external factors, such as market fluctuations, regulatory changes, or cyber threats.

3.1 Types of Risks

Organizations face a wide range of risks, including but not limited to:

- Operational Risks: These arise from the internal processes, people, and systems used in day-to-day operations.

- Financial Risks: These include market risks, credit risks, and liquidity risks that may affect the financial stability of the organization.

- Compliance Risks: These arise from the potential failure to adhere to laws, regulations, or internal policies.

- Reputational Risks: These involve the potential damage to an organization’s brand or public perception due to unethical behavior, product recalls, or data breaches.

- Cybersecurity Risks: With the rise of digital transformation, organizations are increasingly vulnerable to cyberattacks, data breaches, and other IT-related risks.

3.2 Risk Management Process

An effective risk management strategy follows these steps:

- Risk Identification: This involves identifying potential risks that could negatively affect the organization’s operations or objectives.

- Risk Assessment: Once risks are identified, they are assessed based on their likelihood and impact. A risk assessment matrix can help prioritize risks.

- Risk Mitigation: After risks are assessed, mitigation strategies are implemented to reduce or eliminate the risk. This may include internal controls, insurance, or process improvements.

- Risk Monitoring: Risk management is an ongoing process that requires continuous monitoring and reassessment of risks as the business environment evolves.

3.3 Risk Management Frameworks

Several frameworks exist to guide organizations in implementing effective risk management practices:

- ISO 31000: The International Organization for Standardization (ISO) developed the ISO 31000 standard to provide principles and guidelines for risk management. It emphasizes a structured approach to managing risks across an organization.

- COSO ERM Framework: The COSO Enterprise Risk Management (ERM) framework integrates risk management into the governance and performance processes of an organization. It provides a comprehensive approach to managing risk in relation to the organization’s strategy and performance.

3.4 Role of Risk Management in GRC

Risk management is central to the GRC framework as it helps organizations proactively identify and address risks that could prevent them from achieving their strategic objectives. An integrated GRC approach ensures that risk management is aligned with governance structures and compliance requirements. It also promotes a risk-aware culture, where employees at all levels understand the risks and how to mitigate them.

4. Compliance in GRC

4.1 Types of Compliance Requirements

Organizations must comply with various legal, regulatory, and internal requirements, such as:

- Regulatory Compliance: This involves adhering to local, national, and international laws that govern business operations. Examples include GDPR for data privacy, HIPAA for healthcare organizations, and SOX for financial reporting.

- Industry-Specific Compliance: Some industries have specific compliance requirements, such as the Payment Card Industry Data Security Standard (PCI DSS) for businesses that process credit card transactions.

- Internal Policies: Organizations must also ensure that employees comply with internal policies, such as codes of conduct, cybersecurity protocols, and HR policies.

4.2 Compliance Frameworks

Several frameworks and standards guide organizations in establishing compliance programs:

- ISO 19600: This international standard provides guidance on establishing and improving a compliance management system. It emphasizes the integration of compliance into the overall governance structure of the organization.

- SOX (Sarbanes-Oxley Act): Passed in 2002, SOX aims to protect investors by improving the accuracy and reliability of corporate financial reporting. It requires public companies to establish internal controls and procedures for financial reporting.

- GDPR (General Data Protection Regulation): Enforced by the European Union, GDPR governs data protection and privacy. It imposes strict requirements on organizations that process personal data, including obtaining consent from individuals and reporting data breaches.

4.3 Compliance Process

An effective compliance program typically includes the following steps:

- Identification of Legal and Regulatory Requirements: Organizations must identify the laws and regulations applicable to their operations and industry.

- Policy Development: Based on the identified requirements, organizations develop internal policies and procedures to ensure compliance.

- Training and Awareness: Employees must be trained on compliance requirements and the organization’s policies to ensure adherence.

- Monitoring and Auditing: Regular audits and monitoring are essential to assess compliance and identify any gaps or areas of improvement.

- Reporting and Remediation: Organizations must establish reporting mechanisms for compliance violations and take corrective actions to remedy any issues.

4.4 Role of Compliance in GRC

Compliance ensures that an organization operates within the legal and ethical boundaries established by external regulations and internal policies. In a GRC framework, compliance is integrated with governance and risk management processes to create a cohesive approach to achieving business objectives while minimizing legal and reputational risks. Compliance programs also promote a culture of accountability and transparency, ensuring that ethical practices are embedded throughout the organization.

5. GRC Frameworks and Models

Several GRC frameworks and models provide structured approaches for organizations to implement effective GRC programs. These frameworks help standardize GRC practices, ensuring that organizations manage their governance, risk, and compliance activities cohesively.

5.1 OCEG GRC Capability Model

The OCEG GRC Capability Model is a globally recognized framework for implementing GRC in organizations. It provides guidelines for integrating governance, risk management, and compliance into a unified approach that enhances performance, reduces risks, and ensures compliance with regulations.

The OCEG model emphasizes four key areas:

- Learn: Understanding the internal and external business environment, including risks, regulations, and market conditions.

- Align: Ensuring that GRC activities align with the organization’s mission, values, and objectives.

- Perform: Executing GRC processes and initiatives to achieve organizational goals while managing risks and complying with laws.

- Review: Monitoring and evaluating the effectiveness of GRC activities and making necessary adjustments.

5.2 COSO Framework for GRC

The COSO (Committee of Sponsoring Organizations of the Treadway Commission) GRC Framework integrates governance, risk management, and internal controls to provide a holistic approach to managing risks and ensuring compliance. It highlights the importance of embedding risk management into the organization’s governance structure to support decision-making and enhance performance.

5.3 ISO 31000 and ISO 19600

ISO 31000 focuses on risk management, while ISO 19600 provides guidelines for compliance management. Together, they offer a comprehensive approach to managing risks and ensuring compliance with regulations. These standards emphasize the need for an integrated approach to GRC, where governance, risk management, and compliance activities are aligned with the organization’s strategic objectives.

6. Challenges in Implementing GRC

While GRC provides a structured approach to managing governance, risk, and compliance, organizations often face several challenges when implementing GRC programs:

6.1 Siloed Processes

6.2 Resource Constraints

Implementing a comprehensive GRC program requires significant resources, including personnel, technology, and funding. Smaller organizations, in particular, may struggle to allocate the necessary resources to develop and maintain effective GRC processes.

6.3 Regulatory Complexity

The regulatory environment is constantly evolving, with new laws and regulations being introduced regularly. Keeping up with these changes can be challenging, particularly for global organizations that must comply with multiple regulatory frameworks across different jurisdictions.

6.4 Technology Integration

Organizations increasingly rely on technology to manage their GRC activities. However, integrating GRC solutions with existing systems can be complex and costly. Moreover, many organizations face challenges in selecting the right GRC software that meets their specific needs.

7. The Role of Technology in GRC

Technology plays a critical role in modern GRC programs, helping organizations automate processes, monitor risks in real time, and ensure compliance with regulations. The use of technology in GRC can streamline operations, improve decision-making, and enhance overall efficiency.

7.1 GRC Software Solutions

GRC software solutions provide organizations with a centralized platform to manage governance, risk, and compliance activities. These solutions offer several benefits, including:

- Automation of GRC processes: GRC software automates repetitive tasks, such as risk assessments, audits, and reporting, freeing up resources and reducing human error.

- Real-time monitoring: GRC tools provide real-time monitoring of risks and compliance activities, allowing organizations to respond quickly to emerging threats.

- Data analytics: Advanced analytics tools can analyze large volumes of data to identify trends, patterns, and potential risks.

- Improved reporting: GRC software simplifies reporting by providing customizable dashboards and reports that give stakeholders a clear view of the organization’s risk profile and compliance status.

7.2 Emerging Technologies in GRC

Several emerging technologies are transforming GRC processes, including:

- Artificial Intelligence (AI): AI can enhance risk management by analyzing data to identify potential risks and provide predictive insights. AI can also automate compliance tasks, such as monitoring regulatory changes and flagging potential violations.

- Blockchain: Blockchain technology can enhance transparency and accountability in governance processes by providing an immutable record of transactions and decisions.

- Robotic Process Automation (RPA): RPA can automate repetitive GRC tasks, such as data entry, audits, and compliance checks, reducing the risk of human error.

8. The Future of GRC

As organizations face an increasingly complex risk landscape, the future of GRC will be shaped by several key trends:

8.1 Integrated Risk Management (IRM)

8.2 Regulatory Technology (RegTech)

RegTech is a rapidly growing field that uses technology to improve regulatory compliance processes. RegTech solutions can help organizations automate compliance tasks, monitor regulatory changes, and ensure adherence to laws and regulations in real-time.

8.3 Cybersecurity and GRC

With the increasing reliance on digital technologies, cybersecurity risks are becoming a major focus of GRC programs. Organizations will need to strengthen their cybersecurity frameworks to protect against data breaches, cyberattacks, and other digital threats.

8.4 Agile GRC

As organizations adopt agile methodologies in their operations, GRC processes will also need to become more agile and adaptable. Agile GRC emphasizes flexibility and continuous improvement, allowing organizations to quickly respond to emerging risks and regulatory changes.

9. Conclusion

Governance, Risk, and Compliance (GRC) is a critical discipline for modern organizations, providing a structured approach to managing governance structures, identifying and mitigating risks, and ensuring compliance with laws and regulations. By adopting an integrated GRC approach, organizations can enhance decision-making, protect their reputation, and achieve long-term success.

In a rapidly changing business environment, the future of GRC will be shaped by technological advancements, evolving regulatory requirements, and the growing complexity of global risks. To stay ahead, organizations must continue to innovate and adapt their GRC strategies to ensure they remain resilient, compliant, and successful.

References

- OCEG. (2020). GRC Capability Model. OCEG.

- COSO. (2017). Enterprise Risk Management Framework. COSO.

- International Organization for Standardization. (2009). ISO 31000: Risk Management Principles and Guidelines.

- Sarbanes-Oxley Act (SOX). (2002). U.S. Congress.

- European Union. (2016). General Data Protection Regulation (GDPR).

Compliance

Compliance is the act of following rules, laws, and regulations. It applies to legal and regulatory requirements set by industrial bodies and also for internal corporate policies. In GRC, compliance involves implementing procedures to ensure that business activities comply with the respective regulations. For example, healthcare organizations must comply with laws like HIPAA that protect patients’ privacy.